Vanda Pharmaceuticals: Growth, Innovation, and Market Performance in 2025

Vanda Pharmaceuticals headquarters, representing their commitment to biotech innovation.

Vanda Pharmaceuticals has solidified its reputation as a leader in the biotech sector. In 2025, the company delivered impressive financial results, introduced new therapies, and reinforced its dedication to research and development. This article provides an in-depth look at the company's recent achievements and what they mean for the future of pharmaceutical innovation.

Strong Q1 2025 Financial Results

Vanda Pharmaceuticals reported a total net product sales figure of $50 million for the first quarter of 2025. This marks a 5% increase from the same period in 2024. The company's flagship products, Fanapt®, HETLIOZ®, and PONVORY®, all contributed to these robust numbers.

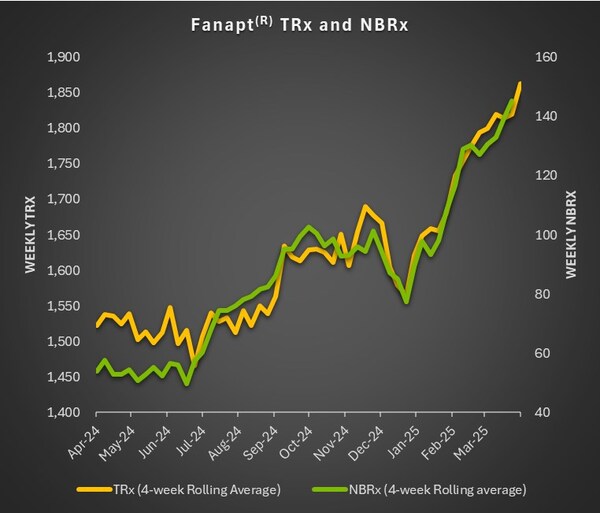

- Fanapt®: Net product sales rose to $23.5 million—a 14% increase compared to Q1 2024.

- HETLIOZ®: Sales grew by 4% year-over-year, continuing to outperform despite generic competition for over two years.

- PONVORY®: While sales dipped 18%, the product saw a record number of new patient prescriptions in April 2025.

For a detailed breakdown of Vanda Pharmaceuticals' Q1 2025 performance, review their complete financial results summary.

Expanding Product Portfolio and Research Pipeline

The company's strategy extends beyond existing revenue streams. Vanda Pharmaceuticals is aggressively expanding its product pipeline, focusing on addressing high unmet medical needs. Several key regulatory and clinical milestones set the stage for future growth:

- Fanapt® received approval for acute treatment of bipolar I disorder in Q2 2024. The product experienced a near-threefold year-over-year growth in new patient starts in Q1 2025.

- Tradipitant and Bysanti™ have New Drug Applications (NDAs) under review by the FDA. The decision dates are set for December 2025 and February 2026, respectively.

- Imsidolimab, a novel anti-inflammatory therapy, is expected to have its Biologics License Application (BLA) submitted in 2025. This compound joins PONVORY® in creating a strong anti-inflammatory franchise.

- Early-stage assets such as VQW-765 and VCA-894A are being developed for acute performance anxiety and rare neuropathies, pushing innovation boundaries further.

To learn more about these products and development strategies, visit the Vanda Pharmaceuticals news page.

Market Outlook and Analyst Perspectives

Vanda Pharmaceuticals' commercial momentum is matched by optimism from industry analysts. According to recent reports, the company is entering a new phase of growth, aiming for over $1 billion in annual revenue by 2030. The surge in Fanapt® prescriptions and the launch of new therapies are critical drivers for this ambitious target.

Wall Street analysts forecast significant upside for VNDA stock, with an average one-year price target of $12.67 compared to recent levels around $4.38. This suggests a strong confidence in the company's strategy and future earnings potential.

Further analysis and detailed market insights are available on the Vanda Pharmaceuticals forecast page.

Challenges and Opportunities Ahead

Despite the positive momentum, Vanda Pharmaceuticals faces key challenges. The generic erosion of HETLIOZ® sales and a net loss of $29.5 million in Q1 2025 underscore financial pressures from increased research, commercial launches, and licensing deals. Nonetheless, the company maintains a strong balance sheet with over $340 million in cash and securities, providing flexibility for continued investment in innovation.

Conclusion

Vanda Pharmaceuticals is leveraging its commercial success, innovative pipeline, and experienced workforce to drive future growth in the biotech industry. The company's robust financials, expanding portfolio, and strategic investments position it well to address pressing medical needs and deliver long-term value for both patients and shareholders.

For further details and the latest updates, explore Vanda Pharmaceuticals' official news releases and industry analysis.