TSM Stock: Is Now the Right Time to Invest in Taiwan Semiconductor?

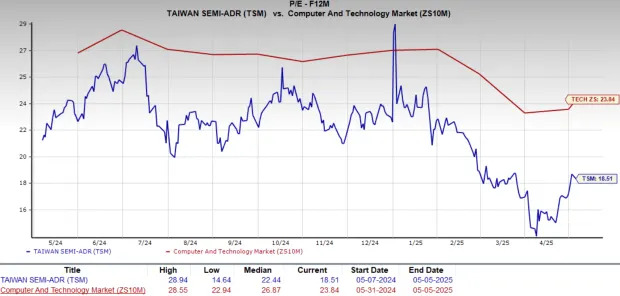

Taiwan Semiconductor Manufacturing Company, commonly known as TSM, continues to capture investor attention. With its leading role in the semiconductor industry and the surging demand for artificial intelligence (AI) technology, TSM stock has recently become a hot topic among traders and long-term investors alike. But after a sharp rally, is TSM stock still a buy, or is it time to take profits?

TSM Stock's Recent Surge: What Drove the Rally?

Over the last month, TSM stock has soared nearly 20%, outperforming many tech sector peers. According to Yahoo Finance, this impressive rally followed renewed optimism in global trade negotiations, particularly between the U.S. and China. As trade worries eased, global equities rallied, and semiconductor stocks—especially TSM—led the charge.

Several factors contributed to this upward momentum:

- AI Demand: The ongoing AI boom places TSM at the center of next-generation computing.

- Technological Leadership: TSM's dominance in high-end chip manufacturing has made it the go-to partner for companies like NVIDIA and Broadcom.

- Market Confidence: Progress in trade talks fueled broader market gains, especially for chip manufacturers previously hit by tariff concerns.

AI Boom and Long-Term Growth Prospects

TSM's future looks promising as artificial intelligence applications continue to expand. The company has become the preferred manufacturing partner for AI accelerators, powering everything from consumer devices to data centers. Analyst reports reveal that AI-related revenues at TSM tripled in 2024, and the growth is expected to continue with a robust compound annual growth rate.

This surge isn't just a flash in the pan. TSM stock is positioned as a backbone for technological innovation—the kind that could drive sustained value for years to come.

Investment Decisions: Buy, Hold, or Sell?

After such a rapid climb, many investors wonder whether it's better to hold on or lock in profits. As noted by Yahoo Finance, TSM's long-term growth outlook remains strong, especially as AI integration broadens across industries. Yet, every investment carries risk, and it's wise to consider the broader market context and personal risk tolerance.

Another perspective comes from MarketWatch, which discusses popular trading strategies associated with TSM stock. Staying informed about such strategies can help investors navigate short-term volatility while keeping an eye on the bigger picture.

Key Takeaways for TSM Stock Investors

- TSM stock has delivered impressive returns, thanks to AI-driven demand and improved trade sentiment.

- The company’s technical prowess and market position make it a core holding for many technology-focused portfolios.

- Investors should balance recent gains with long-term conviction, regularly reviewing industry trends and company fundamentals.

Ready to make your move? Stay updated on TSM stock, monitor AI sector developments, and consider expert insights before making your next investment decision.