TQQQ: A Comprehensive Guide to the ProShares UltraPro QQQ ETF

Investors looking for high-growth opportunities on the NASDAQ-100 often come across the TQQQ ETF. The ProShares UltraPro QQQ (TQQQ) is a popular leveraged exchange-traded fund designed to deliver triple the daily performance of the NASDAQ-100 Index. This article explores what TQQQ is, how it functions, investment considerations, and its recent market dynamics.

Visual representation of TQQQ ETF's leveraged returns and market performance.

What is TQQQ?

TQQQ stands for ProShares UltraPro QQQ. This ETF seeks daily returns that are 300% of the NASDAQ-100 Index’s daily moves, before fees and expenses. By using derivatives like futures contracts and swaps, TQQQ amplifies both gains and losses for investors. The fund is built for traders and investors who have a high risk tolerance and want to maximize short-term exposure to leading tech-focused companies.

How Does TQQQ Work?

TQQQ uses leverage to magnify the performance of the NASDAQ-100. For example, if the index rises by 1% in a day, TQQQ aims to rise by 3%. However, leveraged ETFs like TQQQ are not meant for long-term holding because of compounding risk and potential volatility. Investors must actively monitor their positions and understand that losses can also be tripled.

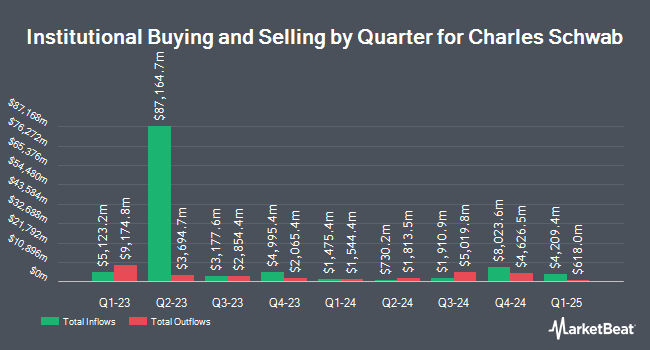

Recent Institutional Activity in TQQQ

TQQQ’s popularity has attracted significant interest from institutional investors. For instance, Raymond James Financial Inc. recently acquired new shares in TQQQ, indicating strong institutional belief in its potential. Meanwhile, investment firms like Tudor Investment Corp ET AL have also taken positions in ProShares UltraPro QQQ, adding to recent trading volume surges.

In contrast, there have also been notable reductions in positions. For example, Cantor Fitzgerald L.P. trimmed its holdings in TQQQ, demonstrating that even large investors review and adjust their exposure to leveraged ETFs as market conditions change. These moves reflect the dynamic and sometimes volatile environment surrounding leveraged products like TQQQ.

Key Considerations Before Investing in TQQQ

- Risk and Reward: TQQQ offers the potential for amplified gains, but losses can also escalate quickly. It is more suitable for experienced investors or active traders.

- Time Horizon: Due to daily leverage, TQQQ is designed for short-term trades rather than long-term investments.

- Market Volatility: Leveraged ETFs magnify market movements, which can impact returns if the market is very volatile or moves sideways.

Dividend and Performance Overview

As of early May 2025, TQQQ is trading around $58.99, with a market capitalization of $22.84 billion. The fund has seen both highs and lows over the past year, ranging from $35.00 to $93.79. Its recent dividend payout stands at $0.1977 per quarter, offering a modest yield of 1.34% for income-focused investors. However, yield is not the main attraction—growth is.

Is TQQQ Right for Your Portfolio?

Deciding to trade or invest in TQQQ comes down to your risk appetite and investment goals. The fund is a powerful tool for those seeking leveraged exposure to the NASDAQ-100, but it requires careful monitoring and a clear exit strategy. Always research thoroughly before investing and consider consulting a financial professional for tailored advice.

For additional details and real-time updates on TQQQ, you can read these in-depth articles:

- Raymond James Financial Inc. Acquires New Shares in ProShares UltraPro QQQ (NASDAQ:TQQQ)

- Tudor Investment Corp ET AL Takes Position in ProShares UltraPro QQQ (NASDAQ:TQQQ)

- ProShares UltraPro QQQ (NASDAQ:TQQQ) Shares Sold by Cantor Fitzgerald L. P.

Conclusion

TQQQ is a dynamic, high-risk ETF that captures the excitement—and volatility—of the NASDAQ-100. With its leveraged returns, this ETF can be a valuable tool for sophisticated investors seeking to capitalize on short-term market movements. Be sure to do your homework and use proper risk management to make the most of what TQQQ has to offer.