Rivian Stock: Latest News, Analyst Ratings, and Investment Insights

Rivian stock remains a focal point for investors interested in electric vehicle (EV) innovation and growth stocks. With market volatility and changing analyst outlooks, understanding the latest trends and forecasts is vital for anyone considering an investment in Rivian Automotive. In this article, we examine recent Rivian stock performance, highlight updated analyst ratings, and provide guidance on what investors should watch in the coming months.

Rivian Stock Performance and Earnings Highlights

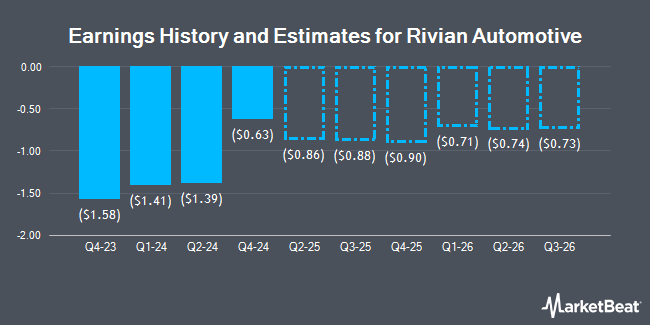

Rivian Automotive, Inc. trades under the ticker symbol NASDAQ:RIVN and has experienced significant movement over the past year. According to a recent MarketBeat analyst roundup, Rivian stock opened at $14.26, marking a strong recovery from its year low of $9.50. The company’s earnings remain in the red, with Wedbush analysts now forecasting an earnings-per-share (EPS) of ($0.86) for Q2 2025, an improvement from earlier projections.

Despite ongoing losses, analyst sentiment hints at cautious optimism. Wedbush currently assigns Rivian an "Outperform" rating and a target price of $18.00, signaling belief in the stock's long-term prospects. Other research firms provide varying perspectives, resulting in a consensus "Hold" rating and an average price target of $13.99. This wide range reflects uncertainty but also opportunity for growth-minded investors.

Insider Activity and Institutional Investment Trends

Key developments affecting Rivian stock include insider transactions and hedge fund activity. Recently, Rivian’s CFO sold a portion of her shares, while CEO Robert Scaringe also reduced his holdings. Although insider selling often raises questions, such transactions are not uncommon among executives at growing tech companies. Meanwhile, institutional investors remain active, with hedge funds and financial firms acquiring new stakes over the past quarter, demonstrating continued interest in Rivian’s trajectory.

Analyst Ratings: Mixed Signals and Price Targets

Analyst insights are essential for understanding where Rivian stock might head next. Some firms, such as Wedbush, have issued bullish targets and outlooks, while others remain more cautious. The repeated "Hold" ratings and moderate price objectives suggest a wait-and-see approach is prevalent among market experts. For detailed analyst breakdowns and latest earnings updates, visit the full MarketBeat research article.

Considerations for Investors

Rivian continues to capture the attention of retail and institutional investors. The company’s lineup of electric trucks and SUVs positions it well within the competitive EV market, but ongoing operational losses and market challenges present risks. Before making a decision, prospective investors should consider the current analyst consensus and review the latest earnings trends and projections.

Conclusion: Is Rivian Stock Right for You?

Rivian stock offers a blend of innovation-driven potential and typical growth stock volatility. With most analysts signaling a "Hold" rating but a few projecting upside, the stock may suit investors with a long-term outlook and high-risk tolerance. Stay updated on future performance and analyst coverage to make informed investment decisions.