Is Rivian Stock a Smart Buy in 2025? Key Metrics, Analysis, and Insights

Rivian stock continues to capture the attention of investors interested in the electric vehicle (EV) market. With growing competition and constant innovation, many are questioning if Rivian (RIVN) is a good buy in 2025. Understanding recent technical trends, financial outlook, and expert opinions is crucial before making any investment decisions.

Recent Technical Moves: Is Rivian Setting Up for a Bullish Run?

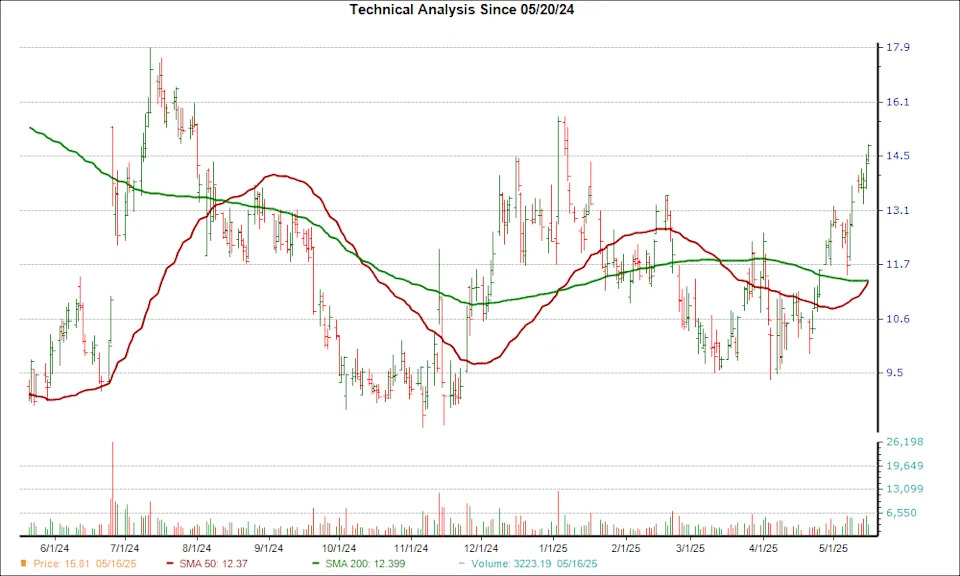

In May 2025,

Rivian Automotive (RIVN) triggered a 'golden cross',

where its 50-day simple moving average crossed above the 200-day average. This pattern often signals a potential bullish breakout. Historically, a golden cross occurs in three phases: the stock price bottoms, short-term momentum overtakes long-term price action, and upward momentum follows. For Rivian stock, this is a significant technical indicator suggesting possible gains ahead.

Backed by strong momentum—Rivian stock rallied over 46% in the last month—a breakout may be on the horizon. Market analysts also noted an improved outlook for the company's earnings, with positive revisions adding to investor optimism.

Analyst Sentiment: What Are the Experts Saying?

Several analysts and investment firms have weighed in on Rivian stock.

BNP Paribas

recently maintained an "overweight" rating on RIVN and even lifted its price target, signaling institutional confidence in the company's future growth prospects.

Meanwhile, experts at

The Motley Fool ask whether investors should consider buying Rivian stock while it remains below $20. Their analysis highlights the stock's potential for upside if the broader EV sector rebounds and Rivian continues to execute on its production and delivery targets.

Earnings Trends and Market Outlook for Rivian Stock

Rivian has shown resilience by improving its earnings outlook. According to recent research,

Rivian’s positive earnings estimate revisions

have contributed to its bullish momentum. With four upward revisions and no downward adjustments in the past 60 days, confidence among the analyst community is rising.

But investing in any EV stock—including Rivian—carries risk. The company must continue scaling its operations, navigating competition, and managing costs to deliver long-term shareholder value. However, if Rivian maintains its current trajectory, the risk-reward profile could become increasingly attractive for patient investors.

Conclusion: Should You Buy Rivian Stock?

Rivian stock presents an intriguing opportunity in the 2025 investment landscape. Technical indicators such as the golden cross, paired with bullish analyst coverage and improved earnings prospects, provide grounds for optimism. Still, potential investors should keep an eye on the company’s execution and the broader market environment.

Before making any investment decisions, consider reviewing detailed research and expert opinions. For a deeper dive, check out articles on Yahoo Finance and

The Motley Fool—gather as much insight as possible to make informed choices. As with all stocks, diversification and thorough analysis are key to successful investing in today's dynamic EV market.