How a Financial Company Navigates Market Challenges in 2025

The financial landscape in 2025 is evolving rapidly. Every financial company, whether in banking, investment, or insurance, faces changing market dynamics. To succeed in today's environment, these companies must adapt to challenges while focusing on growth and stability.

The Role of a Financial Company in Today's Market

A financial company is more than just a provider of banking products. These organizations support individuals and businesses by managing risk, providing capital, and fostering innovation. In 2025, the industry has seen climate events, regulatory shifts, and evolving customer needs shape its core practices. Companies must be agile, reliable, and technology-driven to maintain client trust and ensure financial security.

Performance Trends: Insights from Recent Reports

Analyzing quarterly performance helps us understand how a financial company navigates uncertainty. For example, the Q1 2025 results from Definity Financial Corporation show how catastrophe losses can affect a firm's bottom line. In this recent news roundup from The Insurer, Definity's combined ratio worsened by 60 basis points to 94.5%. Catastrophe-driven claims played a large role, offsetting some gains from reduced expenses. Monitoring such performance metrics gives stakeholders deeper insight into broader industry trends.

Strategies for Growth Amid Market Volatility

Despite challenges, many financial companies continue to show resilience and growth. Definity Financial, for instance, reported gains in gross written premiums (GWP) even as it faced elevated catastrophe losses. According to Insurance Business Canada, strong personal and commercial lines helped them offset ice storm claims and harsh winter damage. These results underline the importance of diversification and risk management within a modern financial company.

Analyst Perspectives and Investor Outlook

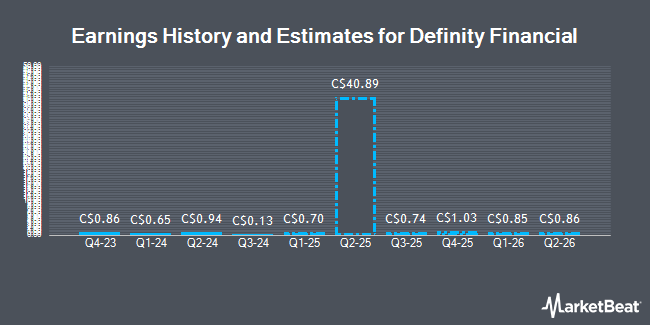

Investor confidence often hinges on robust analysis and forward-looking estimates. Recently, National Bank Financial analysts adjusted earnings forecasts for Definity Financial, reflecting market realities and expectations. As detailed in a MarketBeat research note, consensus ratings and price targets offer clues about the financial company's future valuation. Analysts continue to monitor not just past results, but also how firms position themselves for future stability and growth.

Technology, Risk, and the Future

Looking forward, adopting cutting-edge technology is crucial for any financial company. Digital platforms, data analytics, and modern customer service tools can drive efficiency and meet evolving client expectations. Coupled with strong governance and prudent risk policies, these investments help a financial company maintain resilience, even in uncertain times.

Conclusion: Staying Ahead in a Changing World

2025 brings both opportunities and obstacles for every financial company. Success depends on adaptability, informed strategy, and a relentless focus on client needs. By tracking industry trends and learning from leaders like Definity Financial, stakeholders can navigate risks and seize growth opportunities in the year ahead. For more detailed analysis and live trends, consider exploring the latest industry performance reports and analyst outlooks.